Corn and Soybeans Rule the American Farm. Why That’s a Growing Problem, in Charts

- Serena Valentino

- Sep 1, 2025

- 3 min read

By Patrick Thomas | Graphics by Stephanie Stamm and Elizaveta Galkina

Sept. 1, 2025 8:00 am ET

Bumper crops and diminished demand for U.S. products are pressuring farmers’ profits

American farmers are good at producing two crops: corn and soybeans. Too good, actually.

Farmers are expected to harvest one of the largest crops in history in the coming weeks, according to the U.S. Department of Agriculture. The harvest follows several years of bumper crops for farmers, fueling a glut that is driving down commodity prices. Weaker prices are crimping profits and farmers’ ability to stay afloat.

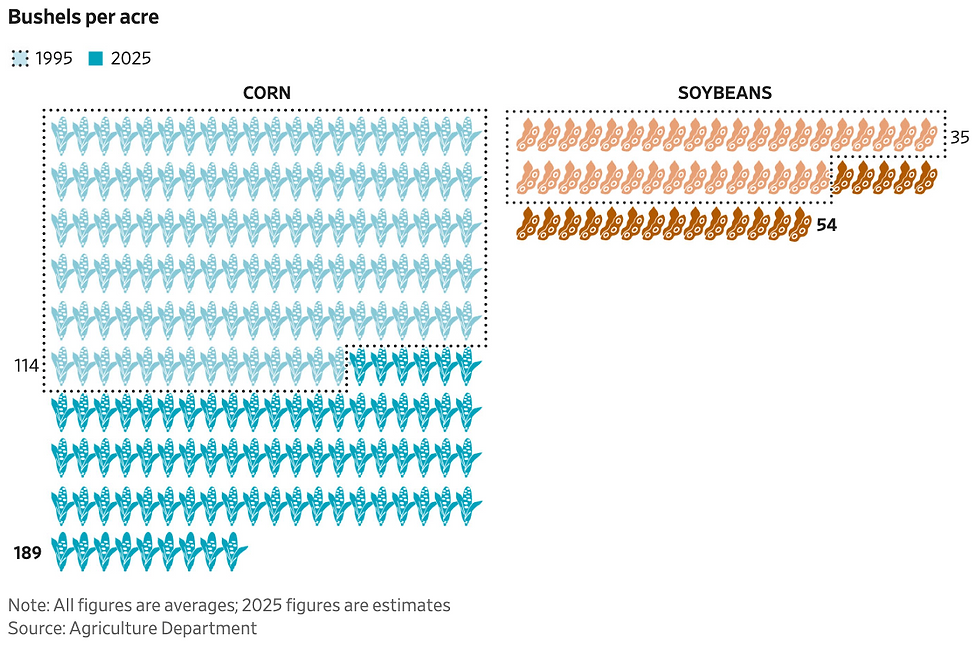

Technological advancements from the world’s largest seed and pesticide companies are expected to increase harvests in the coming years.

The current market dynamic is years in the making. American farmers have been encouraged for decades to plant more acres and boost their harvests for a growing global population. The expectation was that new export destinations would emerge, according to industry officials.

Finding partners beyond China has been difficult. Shifting trade policies and tariffs have complicated that equation further, leaving more crops in U.S. grain bins and countryside elevators.

“We need markets fast for this supply,” said Kenneth Hartman Jr., an Illinois farmer and president of the National Corn Growers Association trade group.iculture Department

Most of the corn and soybeans farmers produce ends up in fuel, exported to other countries or in feed to help fatten hogs, chickens or cattle. A smaller portion is processed into food and ingredients, including cereal. Roughly 3% of U.S. corn production goes toward making corn syrup used for a variety of beverages, such as soda and energy drinks.

The farm economy relies heavily on government requirements for a certain amount of its crops to be blended into fuel: corn into ethanol and soybean oil into diesel. Farmers worry that the government’s fuel mandates won’t keep pace with their expanding harvests.

For 2025, corn farmers are facing estimated losses of more than $160 an acre, according to the corn lobby, largely because of rising expenses for fertilizer, seeds, equipment and pesticides. The losses follow several years of declining profits.

“I think they’ve got one eye on their fields and another eye on the futures prices, which are pretty low,” Bill Anderson, chief executive of seed and pesticide giant Bayer, said about farmers on a recent call with reporters.

Farmers shell out for biotech seeds and cutting-edge pesticides that are making crops better at withstanding drought and extreme heat. They harvested 2% fewer acres last year than they did in 1924 but produced 729% more corn, showing just how far modern farming has come.

Mark Belter farms corn and soybeans on 8,000 acres in eastern North Dakota. He has spent years expanding the size and scale of his farmstead in an attempt to cut costs and turn a profit.

Belter still can’t make enough money. He lost $400,000 last year. He is relying on getting about $200,000 back as part of Congress’s $10 billion farmer bailout passed in December. This year could be more of the same as crop prices are whipsawed by President Trump’s trade battles, including with big buyers of U.S. crops such as China. So far, Chinese buyers haven’t bought any U.S. soy from the coming harvest.

“We don’t like to get government handouts, but we don’t like to go broke either,” Belter said. “It’s a tough time in row-crop production.”

Over the past five years, China has imported on average about 61% of the world’s available soybean supplies. Securing large quantities of soybeans became critical for China during the 1990s as the country’s growing middle class developed a taste for pork and poultry, which are fed on soybean meal.

“U.S. soybean farmers cannot survive a prolonged trade dispute with our largest customer,” wrote Caleb Ragland, a Kentucky soybean farmer and president of the American Soybean Association, in an August letter to Trump.

Roughly 60% of the $45 billion in soybeans, meal and soy oil produced in the U.S. annually is exported. America’s share of global corn exports dropped to 33% in 2024 from 59% in 2004, because of the lingering effects of Trump’s trade wars and increased competition from other nations.

Brazil overtook the U.S. as the world’s top exporter of corn and soybeans in recent years. It has a significant amount of arable land and has invested in modernizing its agriculture technology and supply chains.

Trump’s first trade war led to more than $27 billion in losses of agricultural exports, according to USDA research. The federal government sent about $23 billion to compensate farmers during Trump’s first term.

Trump administration officials and lawmakers have been considering another bailout for farmers this year.

“We’re seeing the same thing that farmers are seeing with regard to commodity prices,” said Deputy Agriculture Secretary Stephen Vaden at a recent farm trade show. “We’ve got to get them from this growing season to the next.”

Visit WSJ for the original article.

Comments